In 1992, Mitt Romney was running Bain Capital, a private equity firm. Bain Capital bought American Pad & Paper Co. (Ampad) for $5 million.

Over the next several years Romney's firm bled the company dry. Hundreds of workers lost their jobs. Stockholders were left with worthless shares. Creditors and vendors were paid less than 50 cents on the dollar. While they were exploiting the company, Romney's firm charged Ampad millions of dollars in "management fees." In all, Romney and his investors reaped more than $100 million dollars from the deal.

In 1992, Bain Capital acquired American Pad & Paper, or Ampad, from Mead Corp., embarking on a ''roll-up strategy'' in which a firm buys up similar companies in the same industry in order to expand revenues and cut costs.

Through Ampad, Bain bought several other office supply makers, borrowing heavily each time. By 1999, Ampad's debt reached nearly $400 million, up from $11 million in 1993, according to government filings.

Sales grew, too - for a while. But by the late 1990s, foreign competition and increased buying power by superstores like Bain-funded Staples sliced Ampad's revenues.

The result: Ampad couldn't pay its debts and plunged into bankruptcy. Workers lost jobs and stockholders were left with worthless shares.

Bain Capital, however, made money - and lots of it. The firm put just $5 million into the deal, but realized big returns in short order. In 1995, several months after shuttering a plant in Indiana and firing roughly 200 workers, Bain Capital borrowed more money to have Ampad buy yet another company, and pay Bain and its investors more than $60 million - in addition to fees for arranging the deal.

Bain Capital took millions more out of Ampad by charging it $2 million a year in management fees, plus additional fees for each Ampad acquisition. In 1995 alone, Ampad paid Bain at least $7 million. The next year, when Ampad began selling shares on public stock exchanges, Bain Capital grabbed another $2 million fee for arranging the initial public offering - on top of the $45 million to $50 million Bain reaped by selling some of its shares.

Bain Capital didn't escape Ampad's eventual bankruptcy unscathed. It held about one-third of Ampad's shares, which became worthless. But while as many as 185 workers near Buffalo lost jobs in a 1999 plant closing, Bain Capital and its investors ultimately made more than $100 million on the deal.

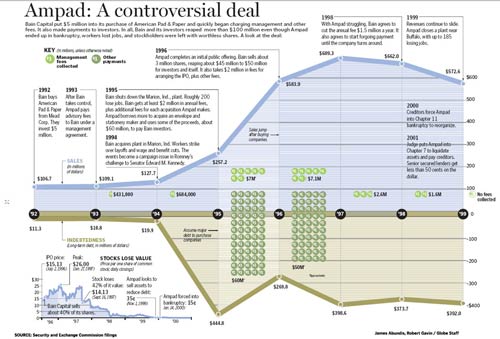

Alongside the article, the Boston Globe also published a separate chart showing the timeline of the Ampad acquisition. Below is also text from the chart:

Ampad: A controversial deal

Bain Capital put $5 million into its purchase of American Pad & Paper and quickly began charging management and other fees. It also made payments to investors. In all, Bain and its investors reaped more than $100 million even though Ampad went into bankruptcy, workers lost jobs, and stockholders were left with worthless shares. [And creditors got less than 50 cents on the dollar.] A look at the deal:

· 1992: Bain buys American Pad & Paper from Mead Corp. They invest $5 million.

· 1993: After Bain takes control, Ampad pays advisory fees to Bain under a management agreement.

· 1994: Bain acquires plant in Marion, Ind. Workers strike over layoffs and wage benefit cuts. The events become a campaign issue in Romney's challenge to Senator Edward M. Kennedy.

· 1995: Bain shuts down the Marion, Ind., plant. Roughly 200 lose jobs. Bain gets at least $2 million in annual fees, plus additional fees for each acquisition Ampad makes. Ampad borrows more to acquire an envelope and stationery maker and uses some of the proceeds, about $60 million, to pay Bain investors.

· 1996: Ampad completes an initial public offering. Bain sells about 3 million shares, reaping about $45 million to $50 million for investors and itself. It also takes $2 million in fees for arranging the IPO, plus other fees.

· 1998: With Ampad struggling, Bain agrees to cut the annual fee $1.5 million a year. It also agrees to start forgoing payment until the company turns around.

· 1999: Revenues continue to slide. Ampad closes a plant near Buffalo, with up to 185 losing jobs.

· 2000: Creditors force Ampad into Chapter 11 bankruptcy to reorganize.

· 2001: Judge puts Ampad into Chapter 7 to liquidate assets and pay creditors. Senior secured lenders get less than 50 cents on the dollar.

STOCK PRICE

July 2, 1996: $15.13 - IPO Price

Jan. 27, 1997: $26.00 - Peak

Sep 16, 1997: $13.13 - Stock loses 42% of its value

Nov 1, 1999: 35 cents - Ampad looks to sell assets to reduce debt

Jan 14, 2000: 15 cents - Ampad forced into bankruptcy